Retirement Accounts: Trust Deed Investing

Getting Started with a Retirement Account

Investing your IRA or other retirement account funds is simple at Wilshire. First, complete the paperwork to establish an account authorized to holds your trust deed investment and fund the account. Next, select the trust deed investment that you feel comfortable with and instruct the IRA custodian to fund the investment. Lastly, collect the payments directly into your IRA. You can view the account history at anytime on our site.

To transfer your existing IRA Account, please click on the boxes below to complete the IRA application and transfer forms.

IRA Investments in Trust Deeds

As we have a trust deed available that meet your investment criteria and objectives, we will send you the information so that you can examine the trust deed and property information at your leisure. If you decide to purchase, we will send the appropriate documents for your signature together with instructions for your IRA custodian to complete the purchase.

Trust Deed Investments

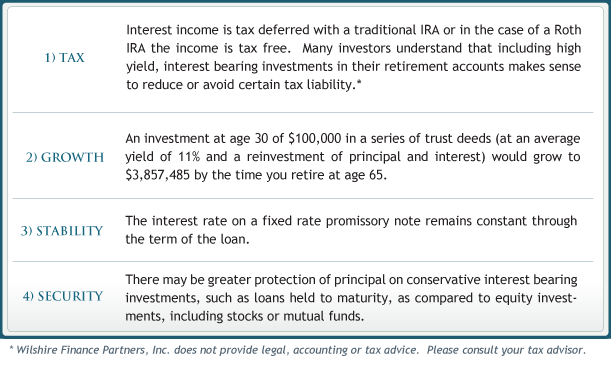

Putting trust deeds into retirement plans can be an excellent for both tax considerations and basic investment fundamentals:

We recommend that investors become familiar with trust deed investments prior to investing. Among other materials, the California Department of Real Estate has published a booklet on trust deed investing which may be located at: www.dre.ca.gov/files/pdf/re35.pdf

Disclosure: Money invested through a mortgage broker is not guaranteed to earn any interest or return and is not insured. State law dictates that we acknowledge that interest and principal on trust deeds is not guaranteed. No investment is completely risk free and past performance is not a guarantee of future results. Before investing, investors must be provided applicable disclosure documents. Mortgage Broker fees will apply unless stated otherwise. California Department of Real Estate license number 01523207. Equal Housing Opportunity